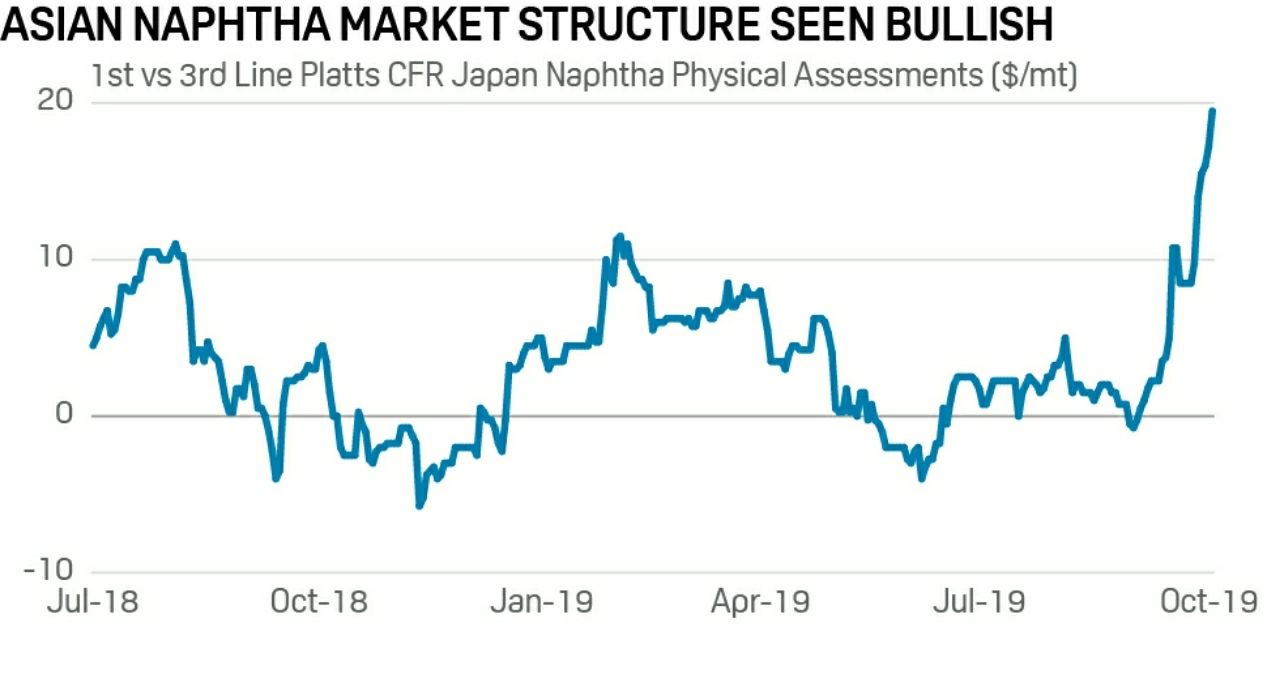

Asian naphtha physical spread widens to 5.5-year high on supply tightness.

The Asian naphtha physical market backwardation widened to its highest level in more than five years as market participants expect the region's supply to tighten and demand to strengthen in the fourth quarter when Asian steam crackers return from scheduled maintenance.

Petrotahlil :The spread between the CFR Japan naphtha first-line and third-line trading cycles -- currently H2 November and H2 December, respectively -- expanded $2.25/mt on the day to be assessed at plus $19.50/mt on Wednesday's Asian close, marking the sixth straight session of increase.

During the Platts market on close assessment process Wednesday, the H2 December cycle was assessed at $492/mt, reflecting a bid at $491/mt, while H2 November was assessed at $511.50/mt, reflecting a bid at $511/mt, which was subsequently withdrawn at the close.

This is the widest spread seen since May 15, 2014, when the physical spread between the first and third cycle was $20.75/mt,Platts data showed.

The steep backwardation is a reflection of the Far East bracing for supply tightness ahead, as Qatar Petroleum plans to conduct a scheduled maintenance at one of its splitter units in November.

Qatar Petroleum will be idling it 146,000 b/d No. 1 condensate splitter at Laffan Refinery 2 complex for the whole of November, market sources said, reducing naphtha exports.

QP's marketing arm, Qatar Petroleum for the Sale of Petroleum Products, exports full-range naphtha and is a key naphtha supplier from the Persian Gulf.

The scheduled turnaround comes as Saudi Arabia restores its oil infrastructure following the drone attacks around three weeks ago that caused a global rally in oil markets.

Saudi Arabia's Abqaiq processing facility and Khurais oil field were attacked September 14, which initially took away 5.7 million b/d of output. On Monday, the head of Aramco's trading division said the country has restored its oil production to more than 9.9 million b/d.

Additionally, Saudi Aramco's 305,000 b/d SASREF refinery will be undergoing maintenance works in October,Platts reported last month.

On the demand side, a handful of Northeast Asian olefin producers are slated to restart their steam cracker units from turnarounds this month, which will boost the demand for paraffinic naphtha in the region.

Taiwan's Formosa Petrochemical Corp. will restart its No. 2 naphtha-fed steam cracker October 5. The cracker is able to produce 1.03 million mt/year of ethylene and 515,000 mt/year of propylene.

Indonesia's Chandra Asri will resume production at its naphtha-fed steam cracker at Cilegon after the current maintenance and debottlenecking exercise, which will raise its ethylene and propylene production capacities to 900,000 mt/year and 490,000 mt/year, respectively.

The benchmark CFR Japan physical naphtha was assessed at $497/mt on Wednesday's Asian close, up $1.75 on the day.

Follow us on twitter @petrotahlil

END